private placement life insurance disadvantages

For the wealthy investor PPLI has several significant benefits including. Private Placement Investment Options Registered variable life products VUL can only invest in registered subaccounts Must have daily valuation Must offer daily liquidity Private placement products can be invested in subaccounts that are unregistered Can.

![]()

Benefits Of Private Placement Life Insurance

In addition an attorney will be needed to help draw up the.

. Unfortunately implementation of the appropriately structured PPLI pro-gram takes the input. The policyholder has to pay for insurance death benefit irrespective of whether there is a need for insurance. Ad Compare the Best Life Insurance Providers.

Ad Get Instantly Matched with Your Ideal Life Insurance Plan. Private placement life insurance PPLI is one of those tools that is truly a cross spec-trum technique. If the wealthy individual invests in them in their personal.

When you own a private placement life insurance and you derive an income from such a pecuniary measure then the policy owner does not owe any income tax whatsoever. Private placement life insurance is a very powerful solution for the right wealthy clients in the right circumstances. Private Placement Life Insurance If ownership is structured properly eg in an irrevocable trust life insurance proceeds may be free from estate taxes as well.

Tax benefits of life insurance including tax-deferred. What are the disadvantages of Private Placement Life Insurance. B Commonly with a minimum investment of.

Zurich private placement life insurance private placement life insurance policy private placement life insurance market private placement life insurance powerpoint private placement life insurance carriers private placement life insurance definition aig private placement life insurance private placement life insurance ppli Bedside lamps such an emotional or merely to. Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public. Because of the life insurance component medical insurability is a requirement otherwise the insurance costs can eat into the tax savings benefits making the strategy less appealing.

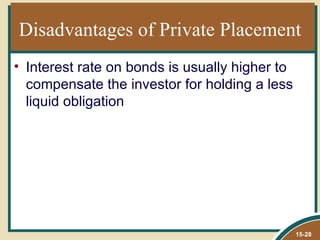

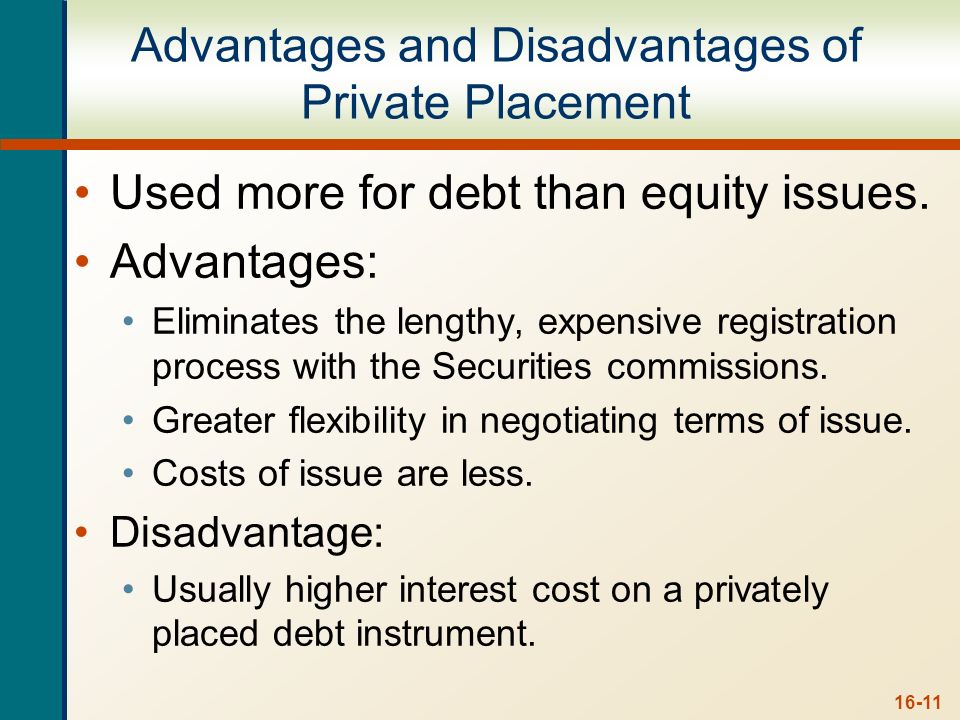

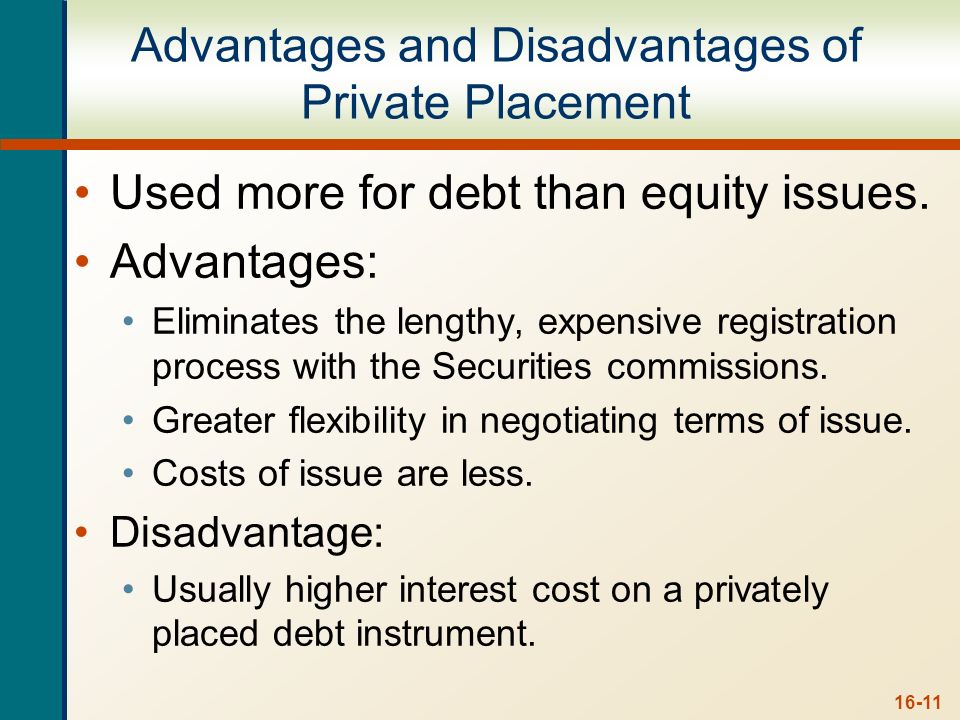

Advantages and Disadvantages of Private Placement Private placements have become a common way for startups to raise financing particularly those in the internet and financial technology sectors. Having elements of life insurance investment estate and income tax planning PPLI can accomplish many goals at one time. It has many advantages but it also has limitations.

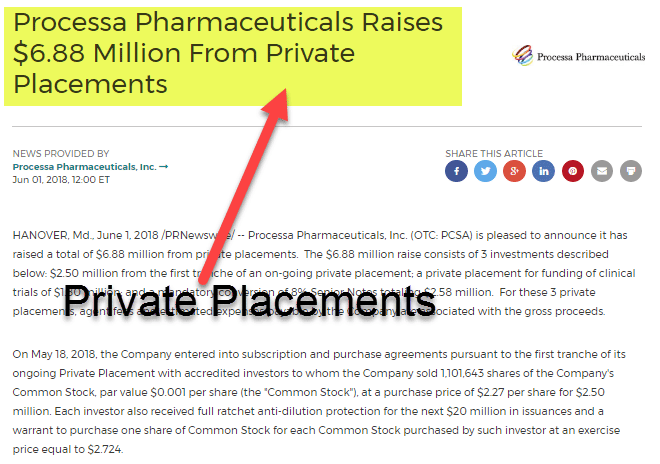

The Most Reliable Life Insurance Companies That Will Actually Cover Your Loved Ones. In time however the market migrated to the United States and applicable IRS regulations followed. Private placement life insurance PPLI is a niche solution designed for wealthy individuals in high tax brackets who have a few million dollars available to commit.

The key advantages to a private placement policy are there are no K-1s vast investment platform and cost. However in situations where medical issues do make buying life insurance impractical you can consider PPLIs close cousin the Private Placement Variable. But unfavorable rulings and.

As such a Private Placement Variable Annuity product and a Private Placement Life Insurance product should only be presented to accredited investors or qualified purchasers as described by the Securities Act of 1933. These investors tend to be more patient and have lower expectations than venture capitalists giving companies a longer time frame for providing a return on their investments. Ongoing fees and premiums are lower.

And are not subject to the same regulatory requirements as registered products. Private placements offer a high degree of flexibility in terms of how much money can be raised from as little as 100000 to tens of millions of dollars. Private placement insurance products are unique investment vehicles that have steadily gained attention in the affluent marketplace over the past decade.

Wide array of investment options including hedge funds private equity and real estate investment trusts. 2022 Editors Top Reviews. A PPLI policy is sophisticated and complex.

Yet because PPLI comes with certain fees and other limitations only a careful case-by-case analysis can determine whether PPLI is right for a given client and situation. Many times those for whom PPLI was designed want to invest in hedge funds but hedge funds can carry significant taxes. Usually clients buy private placement life insurance more as an investment vehicle than because they actually want life insurance.

Private Placement Life Insurance Platform. Of course the average person with a 40000 annual income is not permitted to maintain such a life insurance policy - you may need to establish a 5 million PPLI based on the service that you. The market for individual private placement products originated offshore in the 1990s.

Disadvantages of private placement One major disadvantage of private placement is that bond issuers will frequently have to pay higher interest rates to entice investors. Due to its nature private placement life insurance is only offered to qualified purchasers seeking to invest large sums of money often more than US1 million in the policy. Disadvantages - a Expensive to set up but the tax benefits offset the higher costs to justify the purchase.

Only by working with a.

Top 10 Pros And Cons Of Variable Universal Life Insurance

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Up Benefits And Advantages Taxindiainternational Com

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Up Benefits And Advantages Taxindiainternational Com

Benefits Of Private Placement Life Insurance

Effective Ppli Real Estate Structures 2 Blog Michael Malloy Solutions

/dotdash_Final_Private_Equity_Apr_2020-final-4b5ec0bb99da4396a4add9e7ff30ac03.jpg)

Private Equity Definition How Does It Work

Private Placement Of Shares Top Advantages Disadvantages

7 Ways A Private Placement Both Complements And Differs From A Bank Loan

Key Concepts And Skills Ppt Video Online Download

The Ultimate Guide To Private Placement Life Insurance Worthune

Private Placements And Venture Capital Chapter 28 Tools Techniques Of Investment Planning Copyright 2007 The National Underwriter Company1 What Is It Ppt Download

The Ultimate Guide To Private Placement Life Insurance Worthune

Variable And Universal Life Insurance

Private Placement Life Insurance Life Insurance And Deferred Variable Annuities Setting Up Benefits And Advantages Taxindiainternational Com